Micron Technology in the Memory Supercycle: Full Speed Ahead

Micron Technology in the Memory Supercycle: Full Speed Ahead

Reading Time: 4 minutes

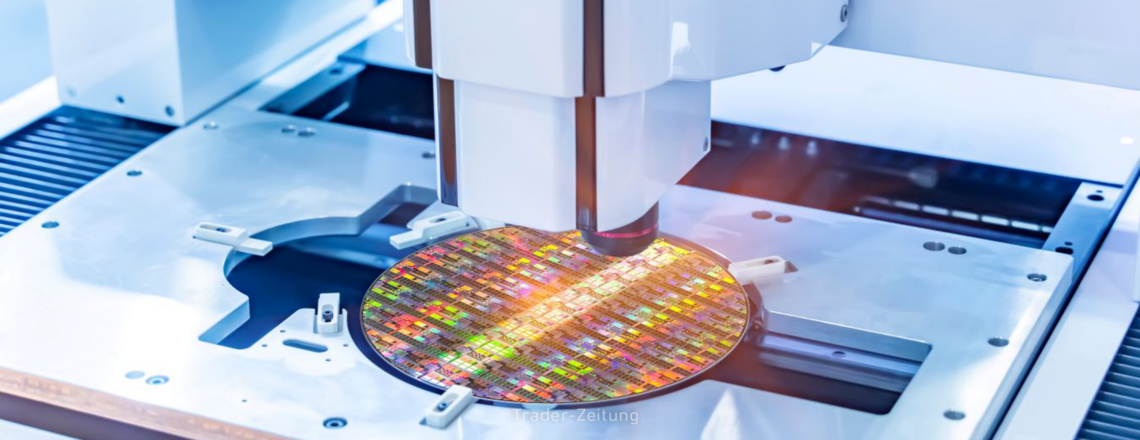

HBM as a growth driver: Micron is practically sold out until the end of 2025 and aims to achieve a 20-25% market share in the future market for High Bandwidth Memory - a key to the AI revolution. Strong figures & attractive valuation: Record revenues, rising margins, and a P/E ratio of 12 for 2026 make the US stock attractive to long-term investors despite risks from China. Growing dominance in AI-driven storage segments Micron is benefitting significantly from the exploding demand for storage solutions for AI and data centers....

Read this article now with a free account.

Your benefits:

- Every month, you can read 5 articles from the premium section for free.

- Monthly 2 trial issues of the Trader newspaper for free.

- Create a personal watchlist with an overview of news about your stock.