Lithium Stocks Soar: Why Albemarle is Taking off Despite the E-Vehicle Slump!

Lithium Stocks Soar: Why Albemarle is Taking off Despite the E-Vehicle Slump!

Reading Time: 3 minutes

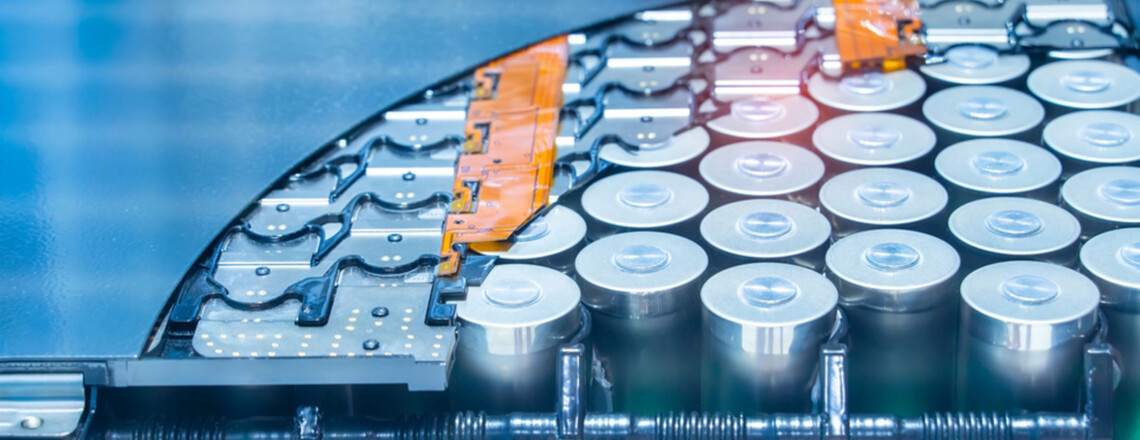

The lithium sector is experiencing a surprising renaissance. While electric vehicle sales in the US are stagnating and the Trump administration rolls back subsidies, lithium stocks are soaring. The trigger : Optimistic forecasts from China and a fundamental shift in demand structure. Chinese impulses drive the market: Li Liangbin, chairman of the Ganfeng Lithium Group, forecasts a demand growth of 30-40% by 2026. His vision : Lithium prices could rise to 150,000 to 200,000 Yuan ($21,000-28,000) per ton – a multiplication of the current quotes...

Read this article now with a free account.

Your benefits:

- Every month, you can read 5 articles from the premium section for free.

- Monthly 2 trial issues of the Trader newspaper for free.

- Create a personal watchlist with an overview of news about your stock.