FormFactor: The Provider of Test and Measurement Solutions Should Benefit From Increasing Demand in the Growing HBM Market

FormFactor: The Provider of Test and Measurement Solutions Should Benefit From Increasing Demand in the Growing HBM Market

Reading Time: 3 minutes

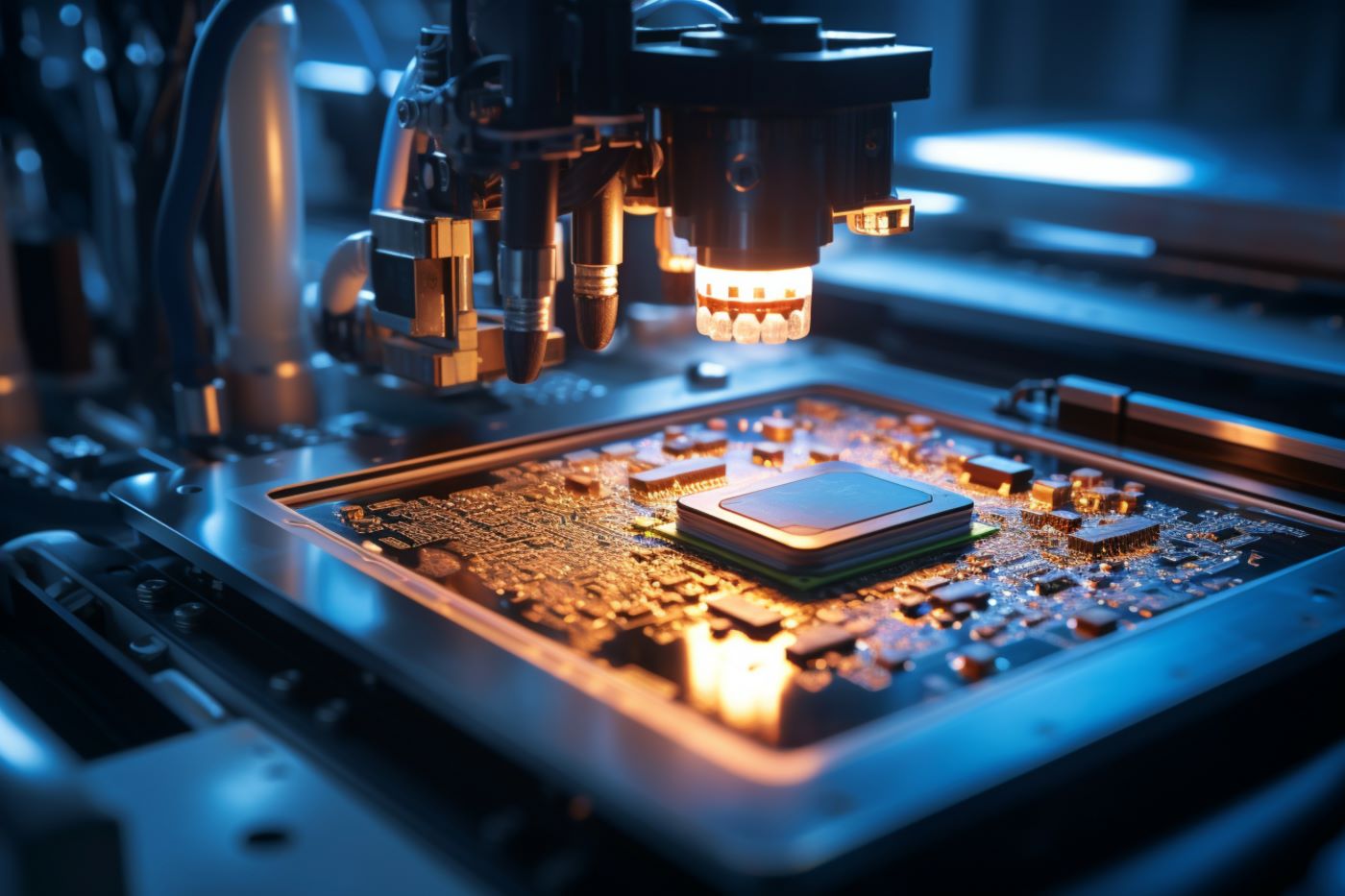

FormFactor is a leading provider of test and measurement solutions focused on the semiconductor industry. It develops, produces and markets advanced test equipment for integrated circuits (ICs) and wafers. The sale of the China business raised $20 million. FormFactor (NASDAQ: FORM) is a leading provider of critical test and measurement technologies for the entire lifecycle of semiconductor products, from characterization, modeling, reliability and design troubleshooting to qualification and production testing. The company offers semiconductor...

Read this article now with a free account.

Your benefits:

- Every month, you can read 5 articles from the premium section for free.

- Monthly 2 trial issues of the Trader newspaper for free.

- Create a personal watchlist with an overview of news about your stock.