Artikel von Stephan Bank

Stephan Bank serves as the editorial manager for the Trendfollowing magazine.

To sharpen the focus on long-term opportunities, he also contributes to the "Tenbagger column." He studied business administration/economics and was able to achieve his first trading profits with the stock of SolarWorld over 15 years ago. Economic developments and stock market activities are his greatest passion. Since everything is interconnected, he also keeps an eye on other asset classes alongside the stock market.

For him, the search for the most exciting companies is like piecing together many puzzle pieces from the large pool of information. One puzzle piece is the approach of technical analysis. Therefore, he has been a certified technical analyst (CFTe) since 2017.

For his long-term investments, he applies his knowledge from fundamental analysis and portfolio management, which was part of his academic work. He also examined the complete value chain of asset management and the insights from behavioral finance. These are particularly important for his trading, as cognitive biases come into play significantly here. From his perspective, trading is one of the best ways to develop personally. We cannot eliminate emotions, but we can recognize and categorize them. Self-observation is one of the greatest levers in trading. He primarily follows a trend-following approach with breakout strategies and also relies on his knowledge of options trading. Because, in the long run, the market tends to rise. Rebound trading occurs only very selectively.

His two most important factors for success in the stock market: Humility before the market and sharpening one's own intuition.

Latest from Stephan Bank

BlackSky: Real-time GEOINT as a scalable business model. Gen3 satellite pipeline fills up, especially internationally. Jefferies sees upside to 23 USD.

The stock of BlackSky Technology (BKSY) belongs on the watchlist of all investors interested in the...

Northland rewards the demand trends of small-cap AXT as an indirect AI beneficiary and sees potential up to $20 (+35%)

The stock of the small-cap company AXT (AXTI) has multiplied approximately fifteen times from its yearly...

Space IPO Starfighters Space: The F-104 Fleet as Air-Based First Stage on the Path to a Launch Service Company

Starfighters Space (FJET) is an emerging space company specializing in suborbital use, human spaceflight...

Amphenol: Physical Connectivity as the key to AI Infrastructure. Truist Sees an Additional 38% Upside Potential.

The stock of Amphenol (APH) has held up relatively stable during the current drawdown of many AI infrastructure...

Spire Global: Under Pressure on the Stock Market, now with Operational Tailwind. New Deal for Missile Defense Capabilities. Price Drop Offers Nearly Doubling Potential According to Stifel.

The share of Spire Global (SPIR) has not yet participated in the recent rallies in the space sector and...

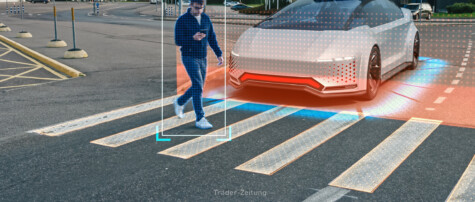

Rivian Automotive: Autonomy, Software, and the Next Growth Step. Baird Upgrades and Sees 40% Upside Potential

The stock of Rivian Automotive (RIVN) recently showed another upward impulse. Rivian positions itself...

Jabil Becomes a Key Supplier for Physical AI Value Creation. Intelligent Infrastructure Drives Q1 Growth to Nearly 20%. Upward Revision as Breeding Ground for Breakout.

Jabil (JBL;i) is an "enabler" of the physical AI value creation: As a global manufacturing services corporation,...

Salesforce is a buy for the Next 2-3 Years!

Salesforce (CRM) is deeply integrated as a leading CRM core system in sales, service, marketing, and...

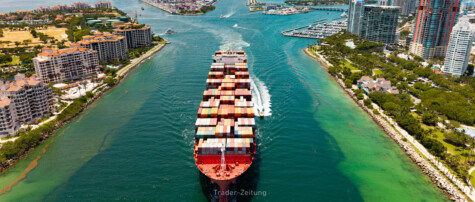

C.H. Robinson: Market Share Gains and Operational Leverage in a Difficult Freight Environment. Analysts See Potential of up to $200 (+27%)

The stock of C.H. Robinson (CHRW) has recently drawn investor interest through two consecutive upward...

Defense Stocks Under Pressure due to Peace Talks: CAE Corp. Resists the Weakness. Here's how!

While some defense stocks - especially in Europe - are under pressure due to progress in talks in Berlin...

Advanced Packaging and HBM Boom: Jefferies Upgrades KLA Corp to Buy with a Price Target of $1,500 (+25%). AI CapEx as Long-Term Tailwind

KLA Corp (KLAC) clearly benefits as a provider of process control solutions for the semiconductor industry...

Weyerhaeuser Starts Rebound. Ambitious mid-Term Targets Support the Bullish Scenario. DA Davidson Sees Over 30% Price Potential

The stock of Weyerhaeuser (WY) has halved since its peak in 2022 and is now starting its rebound movement....

Micro-Caps Break out to a new High: These 3 Stocks Convince with Relative Strength and Interesting Chart Setups.

While the major tech companies dominated the events in the US market, a rotation towards smaller companies...

Scottish Mortgage Investment Trust is a potential beneficiary of the “valuation surprise” from SpaceX. The stock is on the verge of breakout

The stock of Scottish Mortgage Investment Trust is becoming more interesting after the "valuation surprise”...

GE Vernova: In the midst of the largest investment cycle in the electricity sector. Backlog expected to grow from 135 to 200 billion USD by 2028. JPMorgan sees potential up to 1,000 USD (+55 %)

GE Vernova (GEV) presented a picture of a company at its investor day on December 9, 2025, that is in...

UBS sees multiple positive factors for NRG Energy's rising stock prices – outside of the data center business. The upside potential is 27%.

The AI era will only progress if sufficient electricity is available. NRG Energy (NRG) is among the...

Mama’s Creations: From Penny Stock to Growth Star. Revenue Increase Accelerates to a Whopping 50% in Q3.

About ten years ago, the stock of Mama's Creations (MAMA) had reached penny stock levels, hitting a...

Neo Performance Materials – A strategic player for critical raw materials with a significant footprint in Europe.

Neo Performance Materials is an exciting company from the field of resource security based in Canada....

Primoris Services is a benefactor of energy infrastructure expansion. A customer's deal and index inclusion provide a boost.

The stock of Primoris Services (PRIM) has shown longer lower wicks repeatedly in recent days, indicating...

Speculative Stocks on the Rise – USA Rare Earth Jumps on Board. Equity Interests in Companies in the Critical Minerals Sector Expected to Become "the Norm."

On Thursday (December 4), speculative stocks surged one after another. Among them was the stock of USA...